Bitcoin On Track For $1 Million Per BTC “Fair Value”, Analyst Says

An analyst has explained how the “fair value” of Bitcoin appears to be on track to achieve the $1 million milestone by 2035. Bitcoin Total User Count Could Forecast Fair Value Path Forward In a new post on X, analyst Willy Woo has discussed about how the fair value of Bitcoin could look like in the future based on the growth curve in the total user count on the network. Related Reading: Bitcoin Greed No More: Sentiment Back At Neutral After $57,000 Plunge The “total user count” here refers to the total number of investors present in the BTC space. Often, this metric is equated with the total number of addresses on the network carrying a balance, but in reality, it’s not the most accurate method as a lot of investors own multiple wallets. To make an estimation of an adoption curve, Woo has referred to all past studies done on the user count. The analyst shared the below chart in an X post a few days back. The adoption curve of the cryptocurrency over its entire history | Source: @woonomic on X The early part of the chart here is based on Glassnode’s on-chain clustering of addresses into “entities.” An entity is a collection of Bitcoin wallets that Glassnode has determined to belong to the same investor. For the next part of the curve, Woo has added the Cambridge and Crypto.com data on verified exchange users. Finally, the analyst has projected the resulting growth rate forward. According to this curve, there are a total of 426 million Bitcoin investors at the moment, with the number estimated to hit the 0.5 billion milestone by October of this year. Interestingly, the price of the cryptocurrency has been oscillating around this total user count growth curve throughout the years, as the below chart depicts. The adoption curve of the asset compared against its price action | Source: @woonomic on X More specifically, this oscillation in the price around the adoption curve of the cryptocurrency has existed since 2012. This means that in the pre-2012 period (the shaded region in the graph), this pattern doesn’t quite hold. “In the early days price was slow to catch up to user count, BTC didn’t even have a price until the 1000th user came in,” notes Woo. “Price discovery started with early markets like New Liberty Standard and MtGox. By Aug 2011 Bitstamp launched and we had multiple global exchanges to properly price the asset.” Now, if the growth curve of Bitcoin is taken as a guide for its future value as well, then the analyst projects a $1 million per BTC fair value by the year 2035. “Fair value” here is based on the line around which the asset has been oscillating. Related Reading: Crypto Analyst Predicts 244% Shiba Inu Rally Based On Bull Flag From the chart, it’s visible that BTC has historically gained distance over this line during bull markets, so the peak value in future rallies can be significantly more than this fair value. It now remains to be seen how the price of the cryptocurrency will develop in the coming years and whether this relationship between it and the total user count will continue to hold or not. BTC Price Bitcoin has observed a plunge of more than 8% over the past week, which has brought its price down to $58,600. Looks like the price of the coin has registered a sharp drop recently | Source: BTCUSD on TradingView Featured image from iStock.com, chart from TradingView.com

An analyst has explained how the “fair value” of Bitcoin appears to be on track to achieve the $1 million milestone by 2035.

Bitcoin Total User Count Could Forecast Fair Value Path Forward

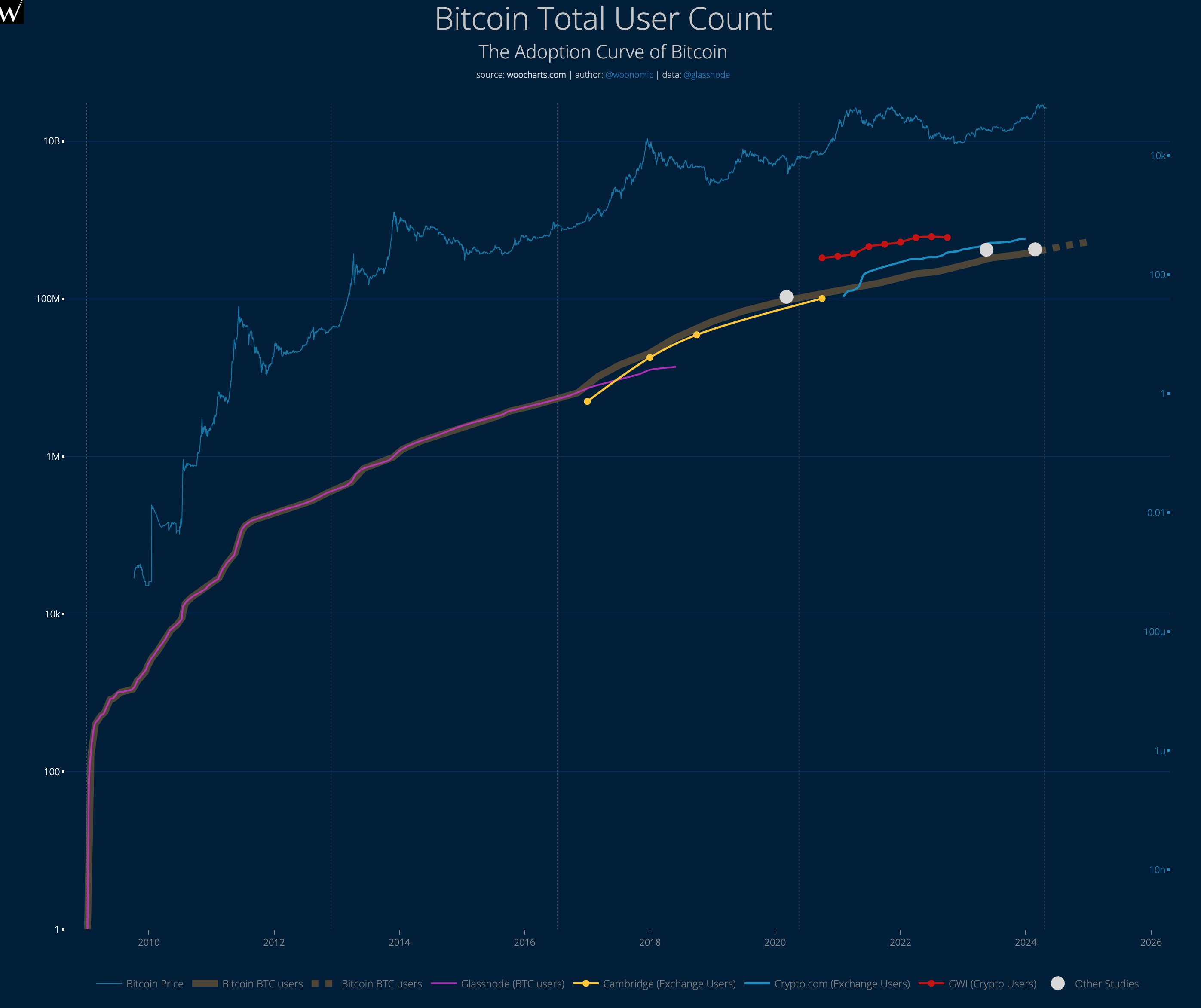

In a new post on X, analyst Willy Woo has discussed about how the fair value of Bitcoin could look like in the future based on the growth curve in the total user count on the network.

The “total user count” here refers to the total number of investors present in the BTC space. Often, this metric is equated with the total number of addresses on the network carrying a balance, but in reality, it’s not the most accurate method as a lot of investors own multiple wallets.

To make an estimation of an adoption curve, Woo has referred to all past studies done on the user count. The analyst shared the below chart in an X post a few days back.

The early part of the chart here is based on Glassnode’s on-chain clustering of addresses into “entities.” An entity is a collection of Bitcoin wallets that Glassnode has determined to belong to the same investor.

For the next part of the curve, Woo has added the Cambridge and Crypto.com data on verified exchange users. Finally, the analyst has projected the resulting growth rate forward.

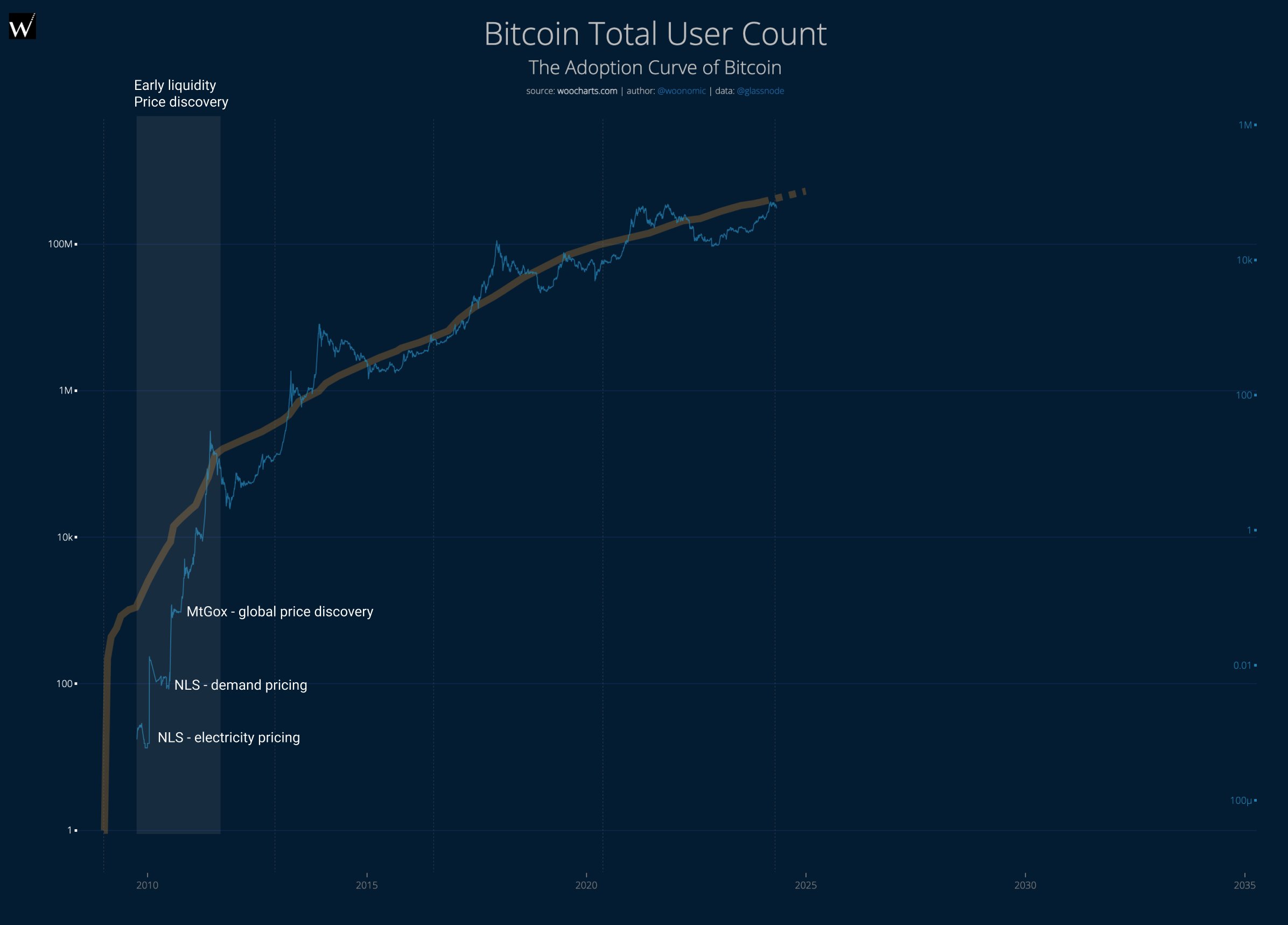

According to this curve, there are a total of 426 million Bitcoin investors at the moment, with the number estimated to hit the 0.5 billion milestone by October of this year. Interestingly, the price of the cryptocurrency has been oscillating around this total user count growth curve throughout the years, as the below chart depicts.

More specifically, this oscillation in the price around the adoption curve of the cryptocurrency has existed since 2012. This means that in the pre-2012 period (the shaded region in the graph), this pattern doesn’t quite hold.

“In the early days price was slow to catch up to user count, BTC didn’t even have a price until the 1000th user came in,” notes Woo. “Price discovery started with early markets like New Liberty Standard and MtGox. By Aug 2011 Bitstamp launched and we had multiple global exchanges to properly price the asset.”

Now, if the growth curve of Bitcoin is taken as a guide for its future value as well, then the analyst projects a $1 million per BTC fair value by the year 2035. “Fair value” here is based on the line around which the asset has been oscillating.

From the chart, it’s visible that BTC has historically gained distance over this line during bull markets, so the peak value in future rallies can be significantly more than this fair value.

It now remains to be seen how the price of the cryptocurrency will develop in the coming years and whether this relationship between it and the total user count will continue to hold or not.

BTC Price

Bitcoin has observed a plunge of more than 8% over the past week, which has brought its price down to $58,600.

What's Your Reaction?