Chinese Financial Institutions Turn to Hong Kong’s New Bitcoin ETF

With Hong Kong asset managers somewhat reluctant to submit applications for the new ETF, a series of multibillion-dollar firms from Mainland China have entered the market.

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As Hong Kong’s Bitcoin ETF is fast approaching, new applications have come in from an unexpected source: some of the biggest traditional asset managers in Mainland China.

Hong Kong’s new ETF has been in the making for several months now, and it’s been attracting no small amount of interest in the digital asset space worldwide. Not only is its in-kind generation model a totally different protocol than the style of Bitcoin spot ETF popularized by the United States, but it’s also an important foothold for ETF acceptance in East Asia. The already-approved Hong Kong futures ETF’s total assets under management (AUM) already passed the $100 million mark in February, and the spot ETF has performed better in every country where it’s gotten the green light. With this economic region having both substantial capital investment and plenty of international finance connections, Hong Kong would make the perfect candidate for a new testing ground in this market.

Even the most bullish reads on the situation, however, have not predicted the emergence of a new player in this space. By late March 2024, there were a large array of HK-based capital firms that had expressed some form of interest in launching their own ETF, but only a comparative handful had actually submitted a formal application. This situation changed radically on April 8th, when a series of big players from Mainland China threw their hats in the ring. Harvest Fund, with over $230 billion in total AUM, and Southern Fund, with over $280 billion AUM, both filed applications of their own through HK-based subsidiaries. Additionally, local media reported that China Asset Management, with $270 billion in AUM, had its own subsidiary enter into an unspecified partnership with existing Bitcoin ETF providers in the city.

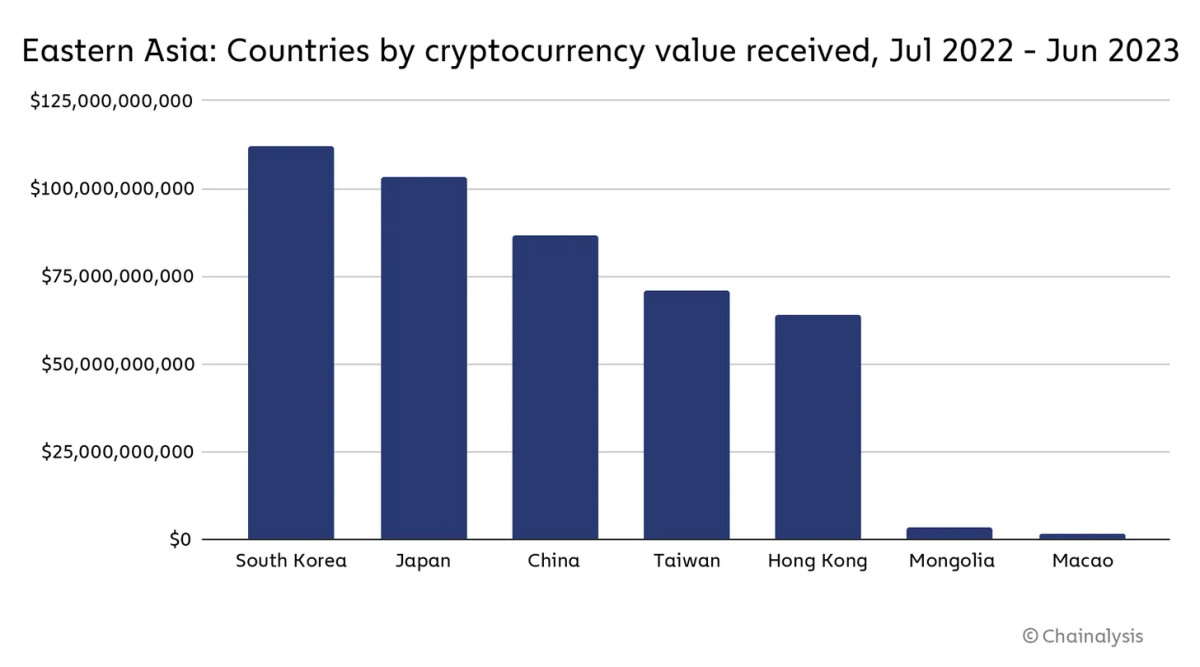

Considering that there are already signs of diminishing ETF hype in the US market, news like this certainly comes as a breath of fresh air. Even if US ETF issuers like BlackRock or Fidelity command several trillion in AUM, the sudden appearance of these multibillion-dollar firms is nothing to sneeze at. It does beg the question, however, of how smoothly interactions between these Mainland firms and Hong Kong financial regulations will actually work together. Isn’t Bitcoin banned in China, with its use among Chinese citizens almost fully underground? How long will a partnership like this actually last? As it turns out, the blanket ban is somewhat overstated in Western media. After all, if Bitcoin was purely contraband in China, why would Chainalysis report $90 billion worth of transactions in one year?

Mainland China has certainly taken a harsher attitude toward Bitcoin in recent years, to be sure. After the Bitcoin mining ban in 2021, one of the largest worldwide hubs for mining dried up practically overnight. However, the apparent crackdown leaves many windows open to the market. Essentially, the main goal for Chinese authorities has been to raise the bar to entry and make it more annoying and difficult for average citizens to continue accessing this market. Additionally, with many legitimate businesses unable to operate, Chinese Bitcoiners are given an implicit warning: “If you get scammed, don’t expect our help or sympathy." Nevertheless, savvy adherents have found ways to continue using their leaderless currency, and these quiet trades evidently amount to many billions.

It’s that same ambiguous attitude that makes these new ETF developments so encouraging. Three of the largest asset managers in all of China have signed onto the project in quick succession, and it’s no small commitment; if these firms become ETF issuers, they’ll be entangled in a business with record-breaking trade volumes and broad international interest. It would hardly be the first time that Chinese capital firms have invested heavily in Bitcoin-related ventures, but mining hardware in faraway Ethiopia is very different from financial instruments in a city that’s legally part of China. By making this leap, these firms have found a way to legally entangle themselves with the world of Bitcoin, and the entanglement will even predominantly involve Chinese citizens.

Such a move could do a great deal to show both investors and regulators that the world of Bitcoin is nothing to fear but instead a very exciting opportunity. Hong Kong’s aforementioned in-kind model means that new buyers will have to trade custodied Bitcoins for a corresponding share in the ETF instead of merely purchasing it with fiat. In other words, there will be an undeniable and direct link between prestigious national businesses and a trade that operates largely out of sight. Could this link convince party officials that Bitcoin has a place in China after all? Will the ETF issuers try to throw their weight around and lobby for Bitcoin’s re-entry into the legal system? How will the complicated relationship between the PRC and Hong Kong impact the entire arrangement?

As far as Hong Kong’s side of the arrangement is concerned, they seem quite committed to the dream of creating a regional crypto hub. Not only have local banks shown an increasing acceptance of the digital asset space as a whole, but this is small potatoes compared to the news from HashKey Global. The South China Morning Post reported on April 8th that HashKey Group, an HK-based exchange that only deals in Bitcoin and Ethereum, opened off its new “Global” initiative with an exchange based in Bermuda. HashKey announced this plan at the Web3 Festival, and the Bermuda operations are set to be just the first step in an ambitious undertaking: the long-term hope is to “overtake US-based crypto giant Coinbase in trading volume within five years." A very tall order.

And yet, Chief Operating Officer Livio Weng did not seem particularly concerned, telling the Post that “We have seen their data and we don’t think that’ll be difficult”. He added that most global competitors are either “easy to use but not compliant”, or “compliant but hard to use”, and the challenges of Chinese regulation have given his company a substantial leg up in this department. It’s been difficult to offer a practical and enticing service to customers while still maintaining regulatory compliance, so the laxer restrictions worldwide will make HashKey a big fish in a small pond. For example, the Bermuda exchange is already set to offer nearly 20 more digital assets than the original Hong Kong operation. Chinese citizens living abroad are also a definite target demographic.

This sort of enthusiasm is certainly a bold statement in the world of Bitcoin! Even in a chaotic market like this, the exchange business’ reigning champs won’t be overthrown easily. Yet, this sort of confidence was reportedly mirrored by the other attendees at the Web3 Festival, as the whole community has pinned its hopes on a rising Bitcoin price. Mainland firms are showing a real willingness to enter the world of Bitcoin through Hong Kong, and the city’s own existing firms are confident that they’ll be worth many billions in short order. Is it really so difficult to imagine that a success here could change the whole paradigm for China?

It’s for these reasons that the upcoming Bitcoin ETF in Hong Kong is so hotly anticipated by observers worldwide. A new spin on the same financial instrument could shake up the entire paradigm, bringing lifeblood to ETFs internationally. However, if China reverses its hostility towards Bitcoin, it could frankly be an even bigger upset than the spot ETF itself. It’s for these reasons that we should watch carefully for developments in this space, as it seems likely that the impact will reverberate in one way or another. The signs are all looking bullish for Bitcoin, and the next big opportunity could be just around the corner.

What's Your Reaction?