CME dominates with record BTC futures contracts amidst market surge

Quick Take The Bitcoin derivatives market is witnessing explosive growth. Data from CoinGlass reveals that the Bitcoin open interest, measured by the total amount of funds committed to open futures contracts, has soared to 484,000 BTC, a peak not seen since August 2023. This marks a roughly 20% increase since the onset of February 2024. […] The post CME dominates with record BTC futures contracts amidst market surge appeared first on CryptoSlate.

Quick Take

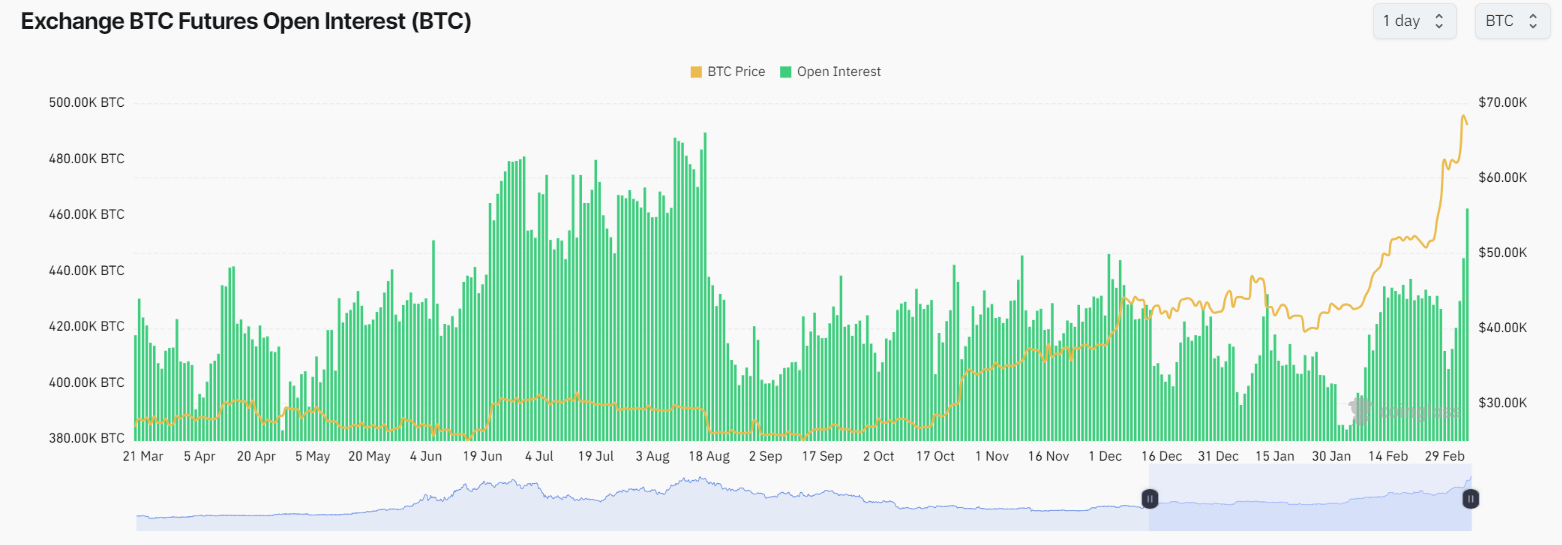

The Bitcoin derivatives market is witnessing explosive growth. Data from CoinGlass reveals that the Bitcoin open interest, measured by the total amount of funds committed to open futures contracts, has soared to 484,000 BTC, a peak not seen since August 2023. This marks a roughly 20% increase since the onset of February 2024.

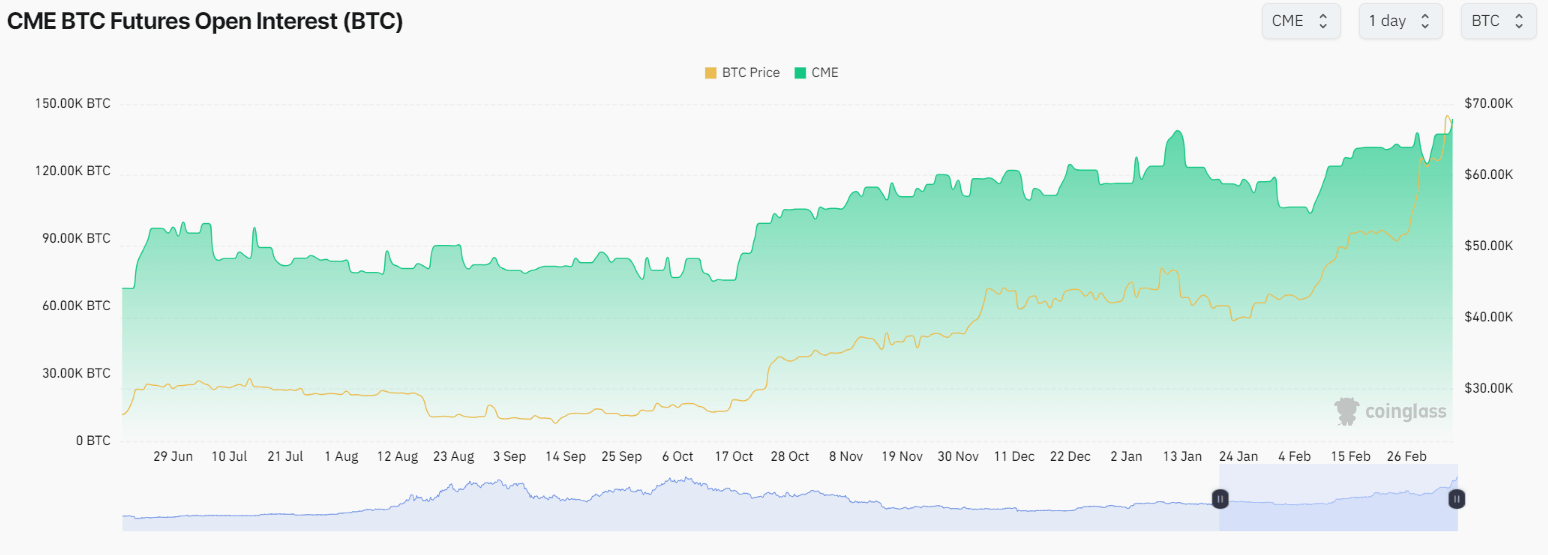

The CME Group claims a significant share of this action, with 143k Bitcoin held in futures open interest contracts, an all-time high representing 30% of the overall futures open interest market. This surge implies an elevated activity within the futures market.

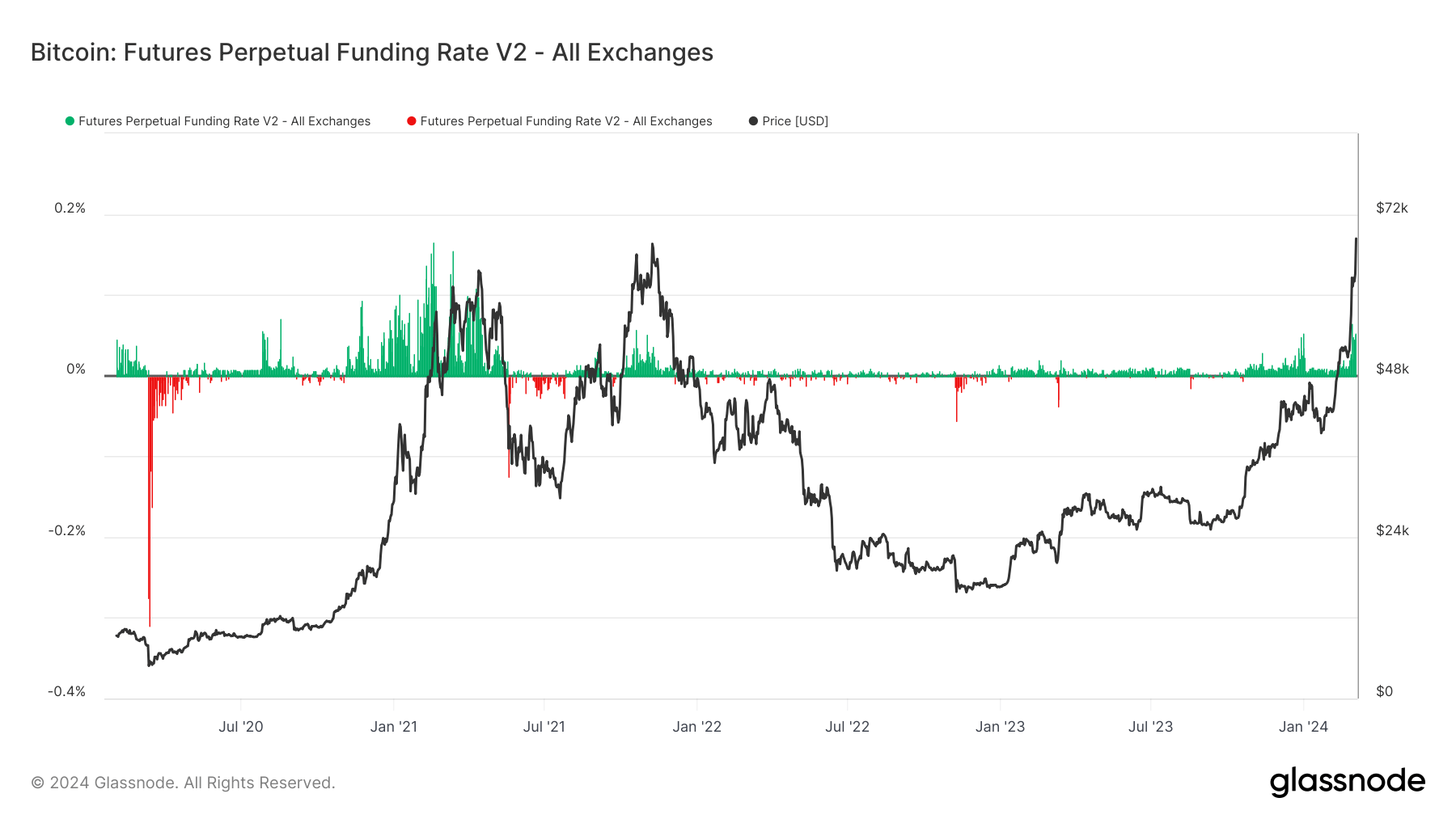

The perpetual funding rate market has also seen an upswing. Over the past week, the average funding rate for perpetual futures contracts has risen to 0.050%, a stark increase from the preceding month’s 0.009%. While these rates may seem high, a retrospective analysis shows that during the 2021 bull run, the average funding rate reached 0.17%.

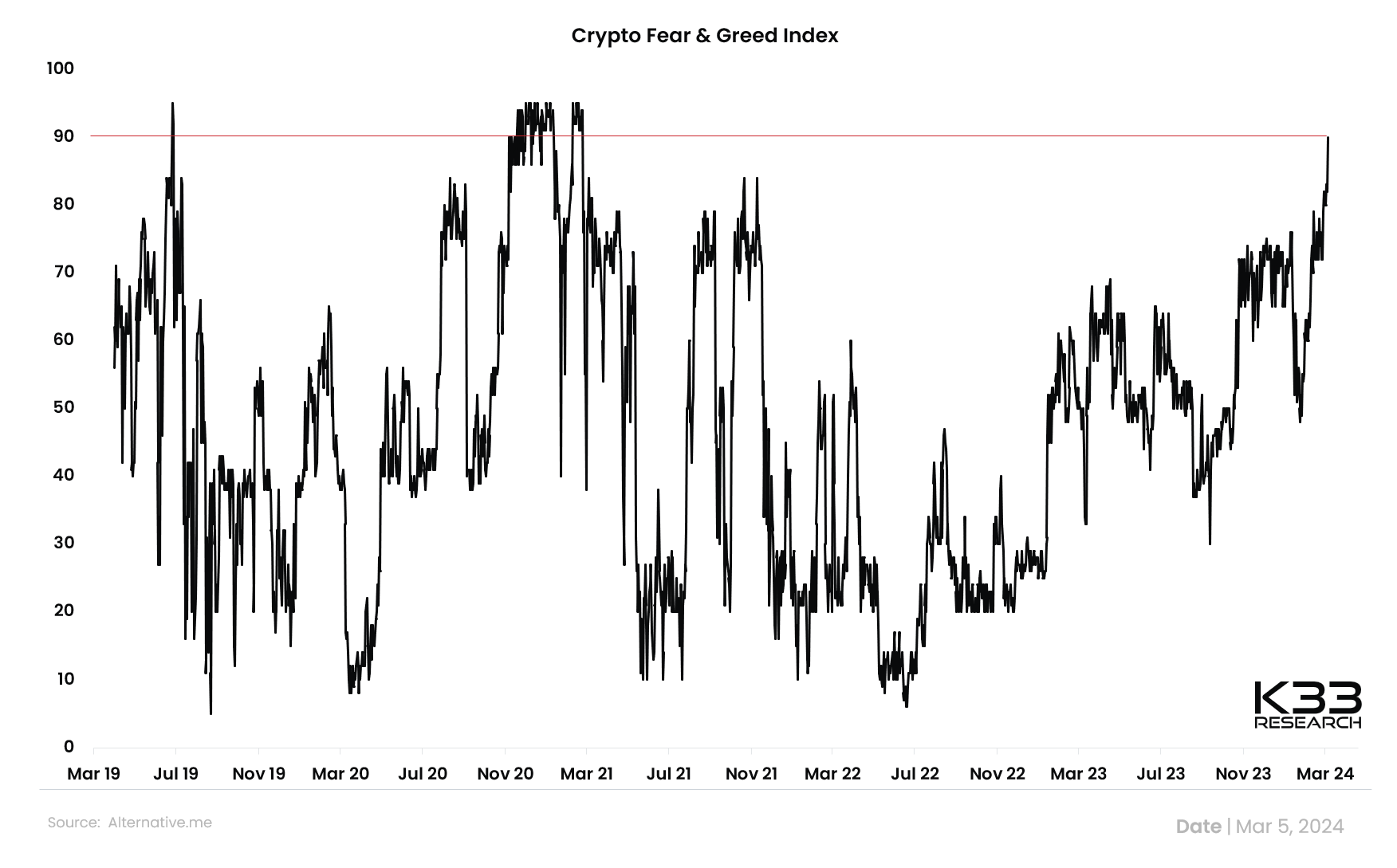

These ‘overheated’ conditions have resulted in a sharp rise in the fear and greed index, currently sitting at 90. Vetle Lunde from K33 Research indicates that the last time this index surpassed 90 was in February 2021, when Bitcoin was trading for roughly $64,000.

This heightened activity in the derivatives market, spurred by leverage, could potentially influence short-term market movements considering the overheated market conditions.

The post CME dominates with record BTC futures contracts amidst market surge appeared first on CryptoSlate.

What's Your Reaction?