Fresh Money From Retail Traders Flows Into Copy Trading As Crypto Derivative Expands: Margex Report

Coinbase won approval to offer cryptocurrency derivative trading to U.S. retail customers, fueling much hope and momentum to the $2.1 trillion cryptocurrency derivative market. Coinbase’s approval arrived following a significant decline in derivative trading volume due to economic uncertainties, regulatory struggles, and a reduction in risk from high wealth accounts and retail traders. Derivative trading, such as futures, options, and others, has dominated the cryptocurrency market since 2014 as investors snap at the opportunity to place bets with little investment for a higher percentage return. A large percentage of the derivative market is influenced by retail traders, fueled by manic meme-stock trading and social media trends on platforms such as X, YouTube and Reddit. Although heavily favoured by institutional investors, who have maintained a fair, open position in the derivative market, Bitcoin exchange-traded funds (ETFs) make up a large share of traded assets. Futures and options trading have had a fair share in the derivative market, but the recent dominance of copy trading is often cited as a key reason for the high volume of the derivative market over the past few months. Copy trading is slowly evolving into a big tool for retail traders looking to explore the derivative market, as many of these traders favour automated trading over spot or manual trading. The data from Margex highlights much attention shifting to copy trading as a new strategy for retail traders looking to increase their profitability while leveraging an experienced trader to produce great profit returns with a profit share automated for both the user and pro trader. Copy Trading And Gen Z Influence On The Derivative Market Copy trading involves users replicating the trading strategies of expert traders. This method allows users to diversify their portfolios, minimize risk, and increase their profitability in the financial market while trades are executed automatically and instantly. The idea of copy trading is to enable users to benefit from the knowledge and skills of well-experienced traders. The users work to enhance their trading outcomes or build better trading or investment skills. Research has shown that 44% of traders are copy traders, signifying an extreme surge of copy trading solutions in the last few years and is greatly influenced by the social age experiencing exponential growth as web3 technologies evolve. Social media and Generation Z users (GEN Z) have amplified the popularity of trading strategies like copy trading through investment threads on X, Reddit, and even YouTube channels, with over 500,000 community individuals actively participating in such financial market discussions. Through social media and online communities, young users have seen a high demand for copy trading as their interest grows through the consumption of financial information. This shows the social aspect significantly influences the adoption of copy trading. By leveraging on the power of online communities and social aspects of trading, copy trading eliminates the rigorous learning phase of analyzing trades for retailers, simplifies trading processes and improves strategies to remain profitable. Copy Trading A Community Building Tool Investors and retail traders have a long history of following the leader or forecaster of the financial market, be it for short-term, medium-term, or long-term portfolio moves. Copy trading has long existed, with many sharing trade ideas or mimicking the trades of experienced traders such as Warren Buffet. These patterns in the past among retailers are seen in the present generation as many retailers or users follow well-experienced traders to replicate their open positions. With more retail traders adopting copy trading, it remains a dominant strategy in the derivative market compared to the spot market. Over 91% of futures trading participants are actively involved in copy trading while recording over 92% of profit returns. According to CCData, the growth of the cryptocurrency derivative market has been influenced by retail traders’ demand for more innovative trading strategies, such as automation tools (copy trading) and AI algorithms, to enhance their trading approach. Many centralized exchanges recorded a new peak of $2.3 trillion in the derivative market. CCData has shown much adoption in the derivative market as compared with spot trading. A large community of retail traders is approaching copy trading to earn a great profit on their investment. Over the past few years, the copy trading community have earned a profit margin of over 74 million USDT, reflecting increased engagement and the copy-trading method by retailers in the derivative market. Many crypto trading platforms have adopted copy trading to fill the needs of retail traders looking for improved and robust trading methods to boost profitability. Margex, a copy trading platform, remains at the top of the list of copy tradi

Coinbase won approval to offer cryptocurrency derivative trading to U.S. retail customers, fueling much hope and momentum to the $2.1 trillion cryptocurrency derivative market.

Coinbase’s approval arrived following a significant decline in derivative trading volume due to economic uncertainties, regulatory struggles, and a reduction in risk from high wealth accounts and retail traders.

Derivative trading, such as futures, options, and others, has dominated the cryptocurrency market since 2014 as investors snap at the opportunity to place bets with little investment for a higher percentage return. A large percentage of the derivative market is influenced by retail traders, fueled by manic meme-stock trading and social media trends on platforms such as X, YouTube and Reddit.

Although heavily favoured by institutional investors, who have maintained a fair, open position in the derivative market, Bitcoin exchange-traded funds (ETFs) make up a large share of traded assets.

Futures and options trading have had a fair share in the derivative market, but the recent dominance of copy trading is often cited as a key reason for the high volume of the derivative market over the past few months. Copy trading is slowly evolving into a big tool for retail traders looking to explore the derivative market, as many of these traders favour automated trading over spot or manual trading.

The data from Margex highlights much attention shifting to copy trading as a new strategy for retail traders looking to increase their profitability while leveraging an experienced trader to produce great profit returns with a profit share automated for both the user and pro trader.

Copy Trading And Gen Z Influence On The Derivative Market

Copy trading involves users replicating the trading strategies of expert traders. This method allows users to diversify their portfolios, minimize risk, and increase their profitability in the financial market while trades are executed automatically and instantly.

The idea of copy trading is to enable users to benefit from the knowledge and skills of well-experienced traders. The users work to enhance their trading outcomes or build better trading or investment skills.

Research has shown that 44% of traders are copy traders, signifying an extreme surge of copy trading solutions in the last few years and is greatly influenced by the social age experiencing exponential growth as web3 technologies evolve.

Social media and Generation Z users (GEN Z) have amplified the popularity of trading strategies like copy trading through investment threads on X, Reddit, and even YouTube channels, with over 500,000 community individuals actively participating in such financial market discussions.

Through social media and online communities, young users have seen a high demand for copy trading as their interest grows through the consumption of financial information. This shows the social aspect significantly influences the adoption of copy trading.

By leveraging on the power of online communities and social aspects of trading, copy trading eliminates the rigorous learning phase of analyzing trades for retailers, simplifies trading processes and improves strategies to remain profitable.

Copy Trading A Community Building Tool

Investors and retail traders have a long history of following the leader or forecaster of the financial market, be it for short-term, medium-term, or long-term portfolio moves. Copy trading has long existed, with many sharing trade ideas or mimicking the trades of experienced traders such as Warren Buffet.

These patterns in the past among retailers are seen in the present generation as many retailers or users follow well-experienced traders to replicate their open positions.

With more retail traders adopting copy trading, it remains a dominant strategy in the derivative market compared to the spot market. Over 91% of futures trading participants are actively involved in copy trading while recording over 92% of profit returns.

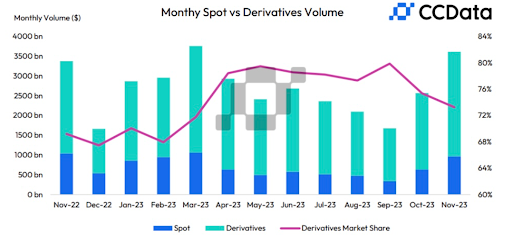

According to CCData, the growth of the cryptocurrency derivative market has been influenced by retail traders’ demand for more innovative trading strategies, such as automation tools (copy trading) and AI algorithms, to enhance their trading approach. Many centralized exchanges recorded a new peak of $2.3 trillion in the derivative market.

CCData has shown much adoption in the derivative market as compared with spot trading. A large community of retail traders is approaching copy trading to earn a great profit on their investment. Over the past few years, the copy trading community have earned a profit margin of over 74 million USDT, reflecting increased engagement and the copy-trading method by retailers in the derivative market.

Many crypto trading platforms have adopted copy trading to fill the needs of retail traders looking for improved and robust trading methods to boost profitability. Margex, a copy trading platform, remains at the top of the list of copy trading platforms for these users.

Margex A Next-Gen Copy Trading Platform

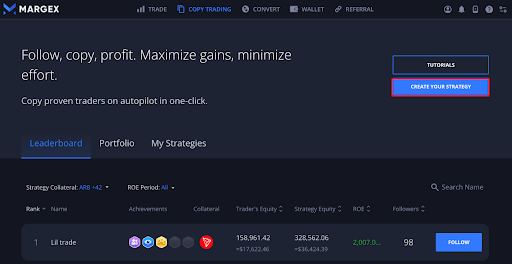

Margex is a next-gen copy trading platform built to help its users recreate success by mirroring the trades of experienced traders in the crypto industry on its intuitive platform.

Margex’s adaptation to better copy trading strategies that many exchanges lack has been a big boost for many retailers. This will address the high demand of users looking for automated approaches to enhance trading results while diversifying their portfolios to maximize profitability.

To demonstrate its seriousness about providing the best services to users, Margex has spent over $3 million to build its copy trading platform with keen attention to usability. It also has a zero-fee converter that enables users to swap tokens easily, and a more ultra-modern wallet will soon be introduced for users to manage assets within a secure platform.

Follow this three simple step guide on participating in the Margex copy trading platform and replicating the trades of more experienced crypto traders. 1 Create An Account With Margex

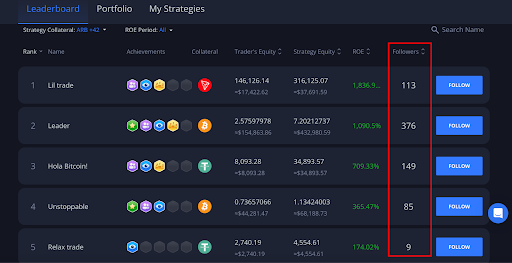

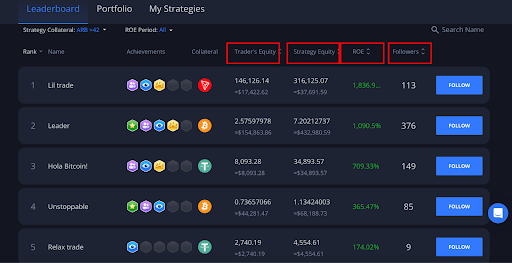

Creating an account with Margex guarantees you the best copy trading experience as it is out to protect the interest of its copy trading users and provides a diverse range of skillful traders you wish to copy their trades. 2 Select Your Traders

Once logged in, navigate to the copy trading page to explore the copy trading leaderboard to select top-performing traders over time. Evaluate its performance metrics, such as followers, traders’ equity, return on equity (ROE), and strategies that align with your risk appetite and investment plans. 3 Allocate Funds

After choosing a trader to follow and confirming your strategy, allocate some funds to replicate their trades. Margex platform mirrors all trades automatically and in real-time.

As low as $10 is the minimum amount Margex requires to participate in copy trading strategies.

What's Your Reaction?