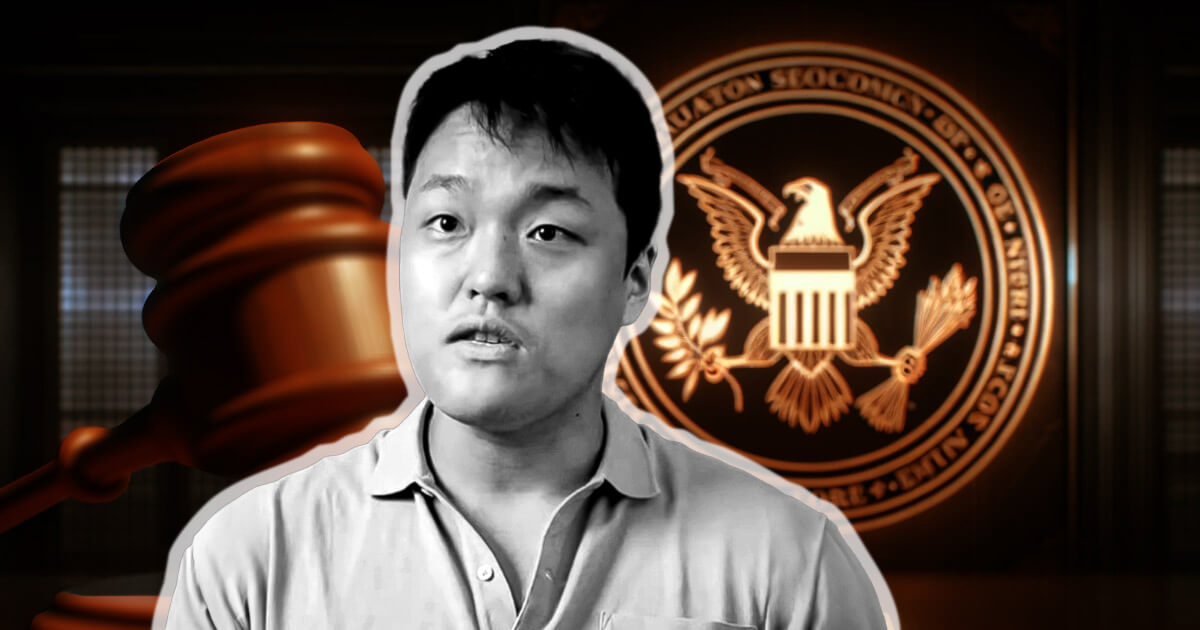

Jury finds Do Kwon, Terraform Labs liable for multi-billion dollar fraud

Following a nine-day trial, a jury found Terraform Labs and its co-founder Do Kwon liable for defrauding investors who lost billions when TerraLUNA collapsed in 2022. The SEC announced the verdict on April 5 in a press release. The regulator emphasized that the verdict holds both parties accountable for a “massive crypto fraud” that caused […] The post Jury finds Do Kwon, Terraform Labs liable for multi-billion dollar fraud appeared first on CryptoSlate.

Following a nine-day trial, a jury found Terraform Labs and its co-founder Do Kwon liable for defrauding investors who lost billions when TerraLUNA collapsed in 2022.

The SEC announced the verdict on April 5 in a press release. The regulator emphasized that the verdict holds both parties accountable for a “massive crypto fraud” that caused “devastating losses for investors” and resulted in the destruction of $40 billion worth of market value “overnight.”

The SEC has yet to obtain penalties or injunctions against Terraform Labs.

In a statement to Reuters, a Terraform spokesperson rejected the verdict and the very premise of the lawsuit, stating the SEC “does not have the legal authority to bring this case.”

In a separate statement to Bloomberg, the company said it plans to appeal the ruling.

Kwon awaiting extradition

For Kwon, the jury verdict only establishes civil liability, not criminal guilt. He faces separate criminal charges in the US and South Korea for his role in the Terra’s collapse.

A federal judge postponed the SEC civil trial from January to late March to allow Kwon to attend the trial. However, the Terra co-founder’s extradition from Montenegro remains undecided.

The country’s Supreme Court recently blocked the process again and sent it back for reevaluation.

Both the US and South Korea are vying for Kwon’s extradition, with Montenegro previously ruling in favor of both countries before the process was blocked multiple times.

SEC case

Terraform Labs’ TerraUSD stablecoin collapsed in May 2022. Apart from the overnight losses mentioned by Grewal, TerraUSD’s key role in the crypto lending market led to a broader liquidity crisis.

The post-TerraUSD market crash extended over the following months, as Bitcoin prices fell from $35,000 in May to less than $20,000 in November.

The SEC obtained a subpoena against Terraform Labs during the crisis in June 2022 but did not file its complaint until February 2023. Before the latest verdict, a December 2023 ruling found that Kwon and Terraform Labs violated the Securities Act 1933.

The post Jury finds Do Kwon, Terraform Labs liable for multi-billion dollar fraud appeared first on CryptoSlate.

What's Your Reaction?