On the rise! I regret not buying these 2 cheap shares earlier. Am I too late?

Mark Hartley is checking the charts to see if these two cheap shares are still good buys. They both show promise, but are their prices now too high? The post On the rise! I regret not buying these 2 cheap shares earlier. Am I too late? appeared first on The Motley Fool UK.

The list of cheap shares on my watchlist has far outgrown my budget, leaving me in a tough position to decide what to buy each month.

Two I’ve overlooked for too long are now up by almost 5% this past month. Did I miss the boat or is this just a temporary rise?

Let’s ask the charts.

Aviva

Aviva (LSE:AV.) is one of the UK’s largest multinational insurance companies, dealing in health, savings, investments and pensions. In fact, my very own pension is entrusted to it.

Regarding performance, I haven’t been blown away by Aviva over the past year. The share price spent much of 2023 declining, only to make a weak and staggered recovery towards year-end.

But since February the share price has rocketed 12% and I wasn’t paying enough attention to grab it!

Most of the recent gains came from news earlier this week that Aviva is rejoining the Lloyd’s insurance market. The return results from a £242m acquisition of Probitas and its fully integrated Lloyd’s platform.

The firm also released its full-year 2023 report last week with better-than-expected results. The combined news lit a firecracker under the share price while I was fast asleep!

But what do analysts forecast for the future?

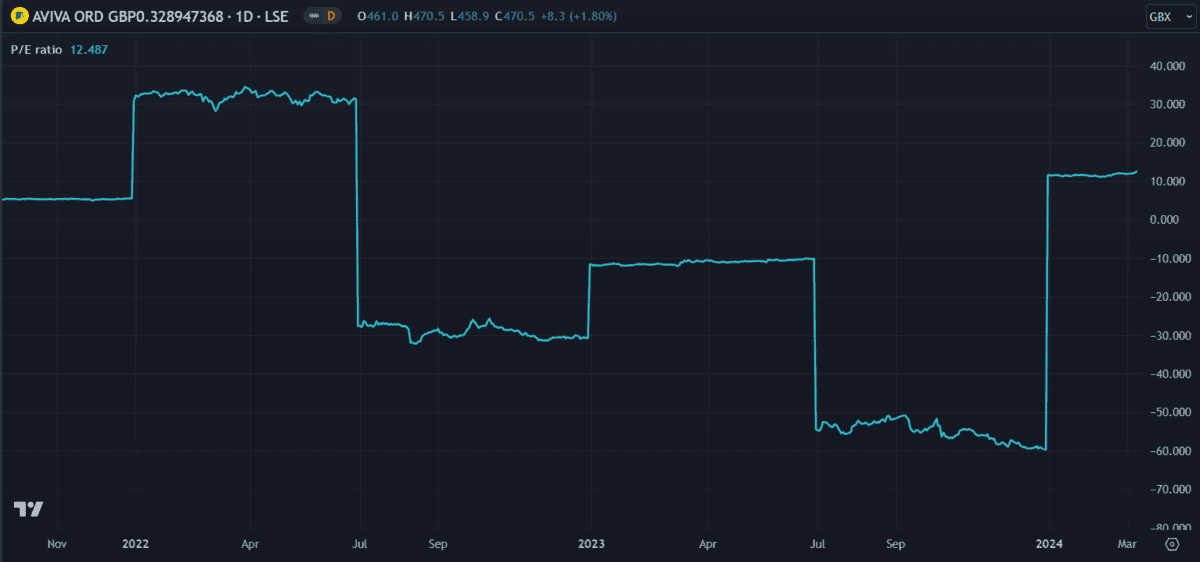

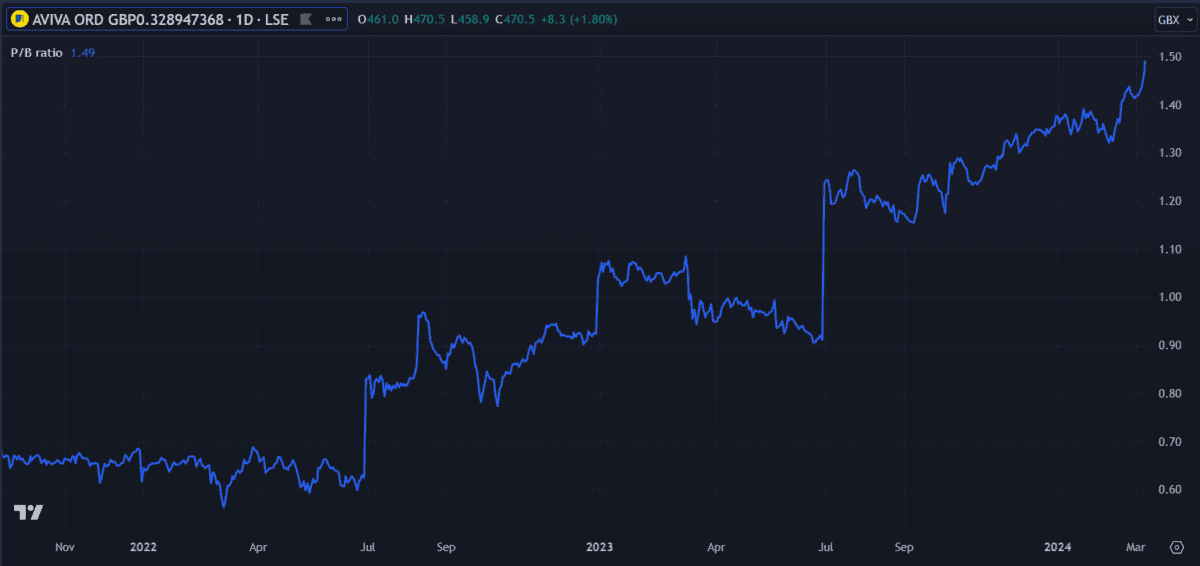

Aviva’s price-to-earnings (P/E) ratio is now at 12.48, up from last year (although lower than in 2022). This suggests the share price is trading at fair value to the industry average, so I probably missed getting in cheap.

Price-to-book (P/B) ratio is another good indicator of value. With Aviva’s P/B ratio now above one, it looks like I missed out on the cheapest entry point. There might be some growth from here but for now, I won’t be buying Aviva shares.

BT Group

I’ve spoken positively about BT Group (LSE:BT.) several times in the past few months but the share price has made me hesitant to buy. It’s been dipping since early December last year. A mild recovery in mid-February renewed my interest until the sale of the iconic BT Tower was announced, leading to further losses.

I should have jumped in then.

Inexperienced investors may think the sale means BT is desperate for capital. If anything, I think it represents its confidence in the transition to a fully digital network. It’s finally shedding the last remnants of a past era.

Truth is, most of the tower’s infrastructure has been offline for over a decade now.

With the share price now in recovery and BT on track to deliver a nationwide network upgrade, I envision positive growth from here.

Yet with a P/E ratio of 5.84, there’s a good chance the BT share price is still selling below fair value.

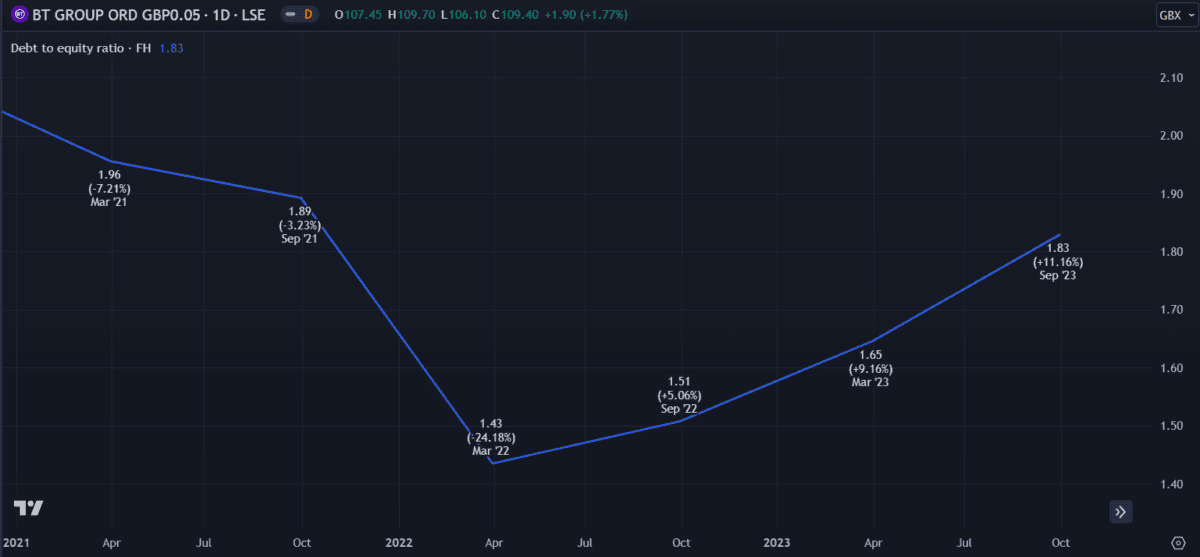

However, BT has been spending a lot in preparation for the upgrade, so its debt is now at a concerning level. Most recent results put its debt-to-equity (D/E) ratio at 1.83. This figure ideally shouldn’t rise above one.

I will need to keep an eye on BT’s debt going forward, particularly considering the current economic uncertainty. However, with a high dividend yield of 7% and an attractive price, it’s firmly on my list of cheap shares for my next buying round.

The post On the rise! I regret not buying these 2 cheap shares earlier. Am I too late? appeared first on The Motley Fool UK.

Like buying £1 for 51p

This seems ridiculous, but we almost never see shares looking this cheap. Yet this recent ‘Best Buy Now’ has a price/book ratio of 0.51. In plain English, this means that investors effectively get in on a business that holds £1 of assets for every 51p they invest!

Of course, this is the stock market where money is always at risk — these valuations can change and there are no guarantees. But some risks are a LOT more interesting than others, and at The Motley Fool we believe this company is amongst them.

What’s more, it currently boasts a stellar dividend yield of around 8.5%, and right now it’s possible for investors to jump aboard at near-historic lows. Want to get the name for yourself?

setButtonColorDefaults("#5FA85D", 'background', '#5FA85D'); setButtonColorDefaults("#43A24A", 'border-color', '#43A24A'); setButtonColorDefaults("#FFFFFF", 'color', '#FFFFFF'); })()

More reading

- Should I buy more after Aviva’s share price jumps on 2023 results?

- Down 50% in 5 years, does the BT share price reflect the 2024-26 dividend forecast?

- I’d buy 81 shares a month of this FTSE 100 stock for £1,000 a year in passive income

- Down 26.7% in a year, what’s next for the BT share price?

- As the Aviva share price rises on strong results, should I buy more?

Mark Hartley has no position in any of the shares mentioned. The Motley Fool UK has recommended Lloyds Banking Group Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

What's Your Reaction?