Yields up to 12.3% 3 top shares investors should consider for a second income

Searching for ways to make a market-beating second income? These popular dividend stocks are worth serious consideration, says Royston Wild. The post Yields up to 12.3% 3 top shares investors should consider for a second income appeared first on The Motley Fool UK.

Looking to make a long-term second income with UK shares? Here are three great stocks I think are worth a close look.

The PRS REIT

Dividends at The PRS REIT (LSE:PRSR) have remained unchanged since the time of the pandemic. Yet the business still offers the possibility of market-beating passive income: for the 12 months to June 2024, the dividend yield is 5%.

This is not all. City analysts expect dividends to start rising again from next year. This reflects continued strong growth in residential rents as the country’s housing shortage worsens. PRS’s own like-for-like rents increased 11% in calendar 2023. This was up from 6% the year before.

It’s also worth remembering that real estate investment trusts (REITs) like this have to pay at least 90% of their yearly rental profits out by way of shareholder dividends. This is in exchange for certain tax advantages, including exemption from corporation tax on rental profits.

Higher-than-normal build cost inflation is a threat to PRS’s bottom line. But on balance, I think the benefits of owning this dividend share outweigh the potential risks.

Please note that tax treatment depends on the individual circumstances of each client and may be subject to change in future. The content in this article is provided for information purposes only. It is not intended to be, neither does it constitute, any form of tax advice.

Bunzl

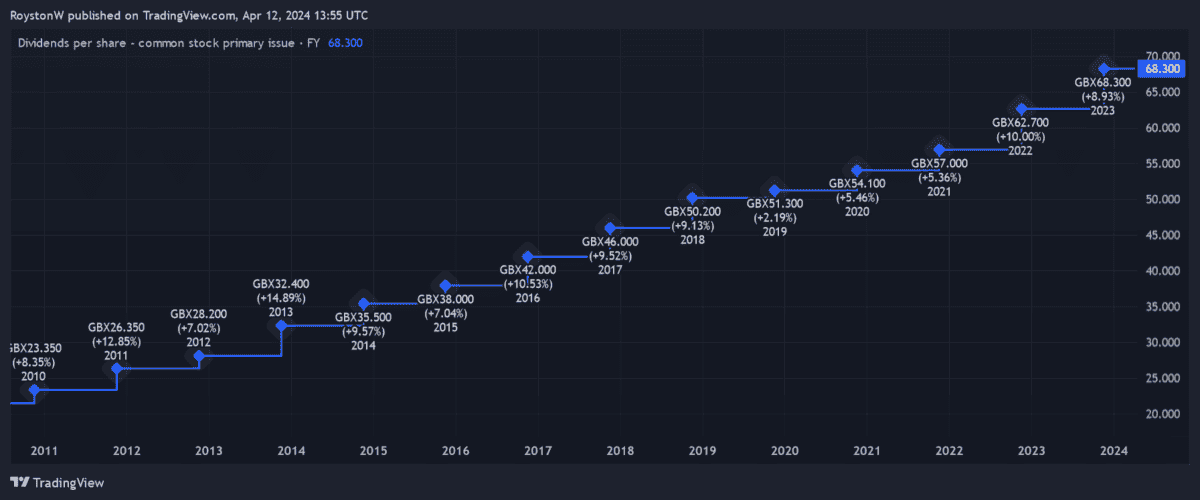

Support services business Bunzl (LSE:BNZL) isn’t famous for having the biggest dividend yields. At 2.4%, its yield for 2024 sits below the FTSE 100 average of 3.7%.

But what the company does have is an exceptional record of dividend growth. Shareholder payouts here have grown every year for 32 years, and at a compound annual growth rate of around 10%.

The company generates vast amounts of cash, which has in turn underpinned that progressive dividend policy and funded a steady stream of acquisitions. The subsequent boost from these bolt-on buys has also driven healthy capital gains in recent decades.

Bunzl’s balance sheet suggests it’s in good shape to maintain its generous dividend policy and thirst for acquisitions, too. Its net debt to EBITDA ratio stood at just 1.1 times as of the end of 2023.

An acquisition-based growth strategy exposes companies to unknown risks. But the Footsie firm’s strong track record on this front helps mitigate any fears I have.

NextEnergy Solar Fund

Purchasing renewable energy stocks could be another good idea as demand for clean energy soars. NextEnergy Solar Fund (LSE:NESF) is one such share worth serious attention today.

The FTSE 250 company has £1.2bn worth of capital invested in more than 100 solar farms and battery storage assets. Most of its money is locked in British assets, though it is expanding its international footprint to exploit overseas opportunities and spread risk.

NextEnergy’s share price has slumped more recently. This reflects a combination of weak UK power prices and high interest rates, problems that could endure in the short term.

But as a long-term investor, I think there’s a lot to like here. What’s more, its sinking share price has pushed the forward dividend yield to a mammoth 12.3%.

The post Yields up to 12.3% 3 top shares investors should consider for a second income appeared first on The Motley Fool UK.

Should you buy Bunzl Plc shares today?

Before you decide, please take a moment to review this first.

Because my colleague Mark Rogers – The Motley Fool UK’s Director of Investing – has released this special report.

It’s called ‘5 Stocks for Trying to Build Wealth After 50’.

And it’s yours, free.

Of course, the decade ahead looks hazardous. What with inflation recently hitting 40-year highs, a ‘cost of living crisis’ and threat of a new Cold War, knowing where to invest has never been trickier.

And yet, despite the UK stock market recently hitting a new all-time high, Mark and his team think many shares still trade at a substantial discount, offering savvy investors plenty of potential opportunities to strike.

That’s why now could be an ideal time to secure this valuable investment research.

Mark’s ‘Foolish’ analysts have scoured the markets low and high.

This special report reveals 5 of his favourite long-term ‘Buys’.

Please, don’t make any big decisions before seeing them.

More reading

- 2 UK shares into which I’d put 100% of my money for passive income

- 2 second income shares I’d buy to hold until 2034!

- How I’d invest £20,000 in a Stocks and Shares ISA to try and maximise my returns

- 2 income stocks I’d buy in an ISA before 5 April

- 3 of the best FTSE 100 stocks for investors to consider buying in April

Royston Wild has no position in any of the shares mentioned. The Motley Fool UK has recommended Bunzl Plc. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

What's Your Reaction?